Commodities – Energy

Crude Oil Falls as Alaska Pipeline Restarts

Crude Oil (WTI) – $90.83 // $0.71 // 0.78%

Commentary: WTI is falling under $91 and Brent is unchanged near $97.43 as volume remains light following the MLK holiday in the U.S. Pit trading resumes on Tuesday, when we can expect the first settlement since last Friday.

Alyeska, operator of the Trans-Alaska Pipeline said that it has completed repairs to the line and that it is once again operational. It expects output to reach 0.5mmbbl/d within 24 hours. Prior to the leak, flows were near 0.6mmbbl/d.

Meanwhile, U.S. equity futures are falling modestly in overnight trade on word that Steve Jobs, CEO of tech giant Apple Inc, will be taking a medical leave of absence for an unspecified amount of time. This is the second time this has happened since 2008. While a single stock will not have a lasting impact on market direction, it could lead to pressure for a single day, especially since equities have rallied so strongly over the past few months.

Technical Outlook: Prices are drifting sideways having put in a bearish Dark Cloud Cover candlestick after retesting support-turned-resistance at rising trend line set from the swing bottom in November. On balance, positioning hints that a move lower is ahead. Initial support lines up at $87.33.

Commodities – Metals

Gold Tests Support Near $1360

Gold – $1363.35 // $0.70 // 0.05%

Commentary: Gold is holding near $1360 as the metal continues to test this notable level of technical support. As we said yesterday, "in order to see a sustainable decline in gold prices, we would need to see a meaningful reduction in investment demand for the metal. Preliminary signs of such a reduction are emerging. Gold ETF holdings have plunged 1.2 million troy ounces since peaking near 68 million troy ounces back in December. They are now at the lowest level since September, when gold was trading at prices more than $100 lower than they are now. Keep in mind, however, that this is by no means the largest drawdown in holdings during gold's 10-year bull run. For instance, we saw a drawdown in excess of over 3 million troy ounces during 2008 (incidentally, there was a big gold price correction during part of that year)."

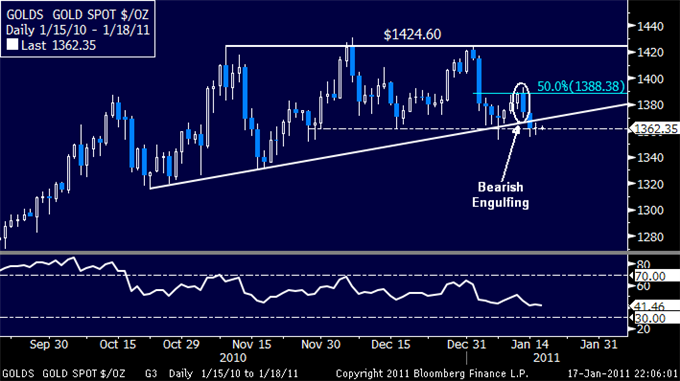

Technical Outlook: Prices followed a Bearish Engulfing candlestick pattern below resistance at $1388.38, the 50% Fibonacci retracement of the 1/3-1/7 downswing, with a break through support at a rising trend line set from late October. Final confirmation of a larger bearish reversal requires a daily close below $1361.39, an outcome that would clear the way for a decline to the $1325-30 region. The trend line (now at $1368.32) has been recast as near-term resistance.

Silver – $28.30 // $0.02 // 0.05%

Commentary: The $28.30 level in silver is comparable to $1360 for gold. In the event of a meaningful correction in the precious metals complex, silver will likely sell off much more dramatically.

The gold/silver ratio rebounded to 48.1, remaining above the four-year low near 46 set last month. (The gold/silver ratio measures the relative value/performance of the two precious metals. A higher ratio indicates gold outperformance, while a lower ratio indicates silver outperformance)

Technical Outlook: Prices reversed sharply lower at the $30.00 figure, dropping back to horizontal support at $28.32. A daily close below this level exposes $26.71. The $30.00 level remains as near-term resistance.

No comments:

Post a Comment