Stock Investor Sentiment: Extremes Persist

2011 Stock Market Outlook And Video – Part 2

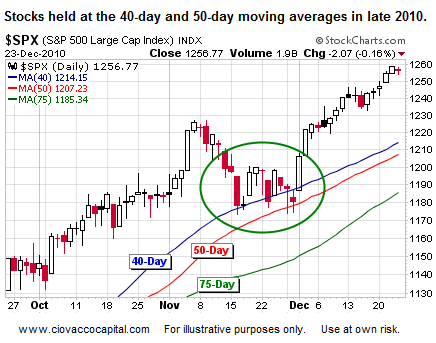

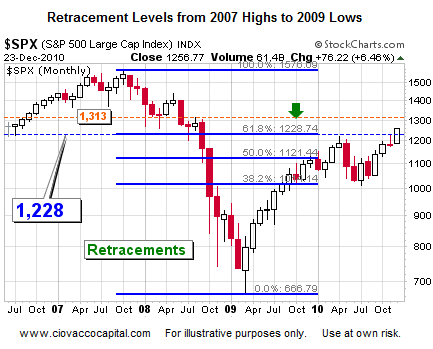

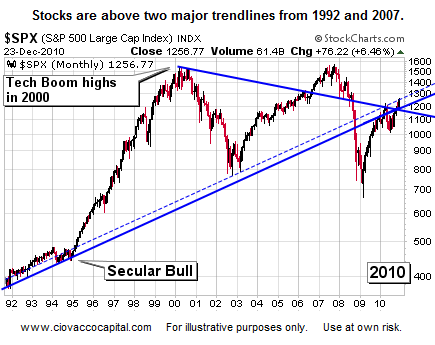

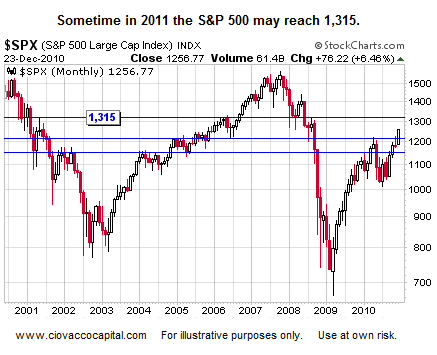

As we kick off 2011, there are plenty of things for investors to worry about, including budget imbalances in developed nations, high levels of bullish sentiment, and a fear of rising interest rates. As of late December 2010, the market's technical profile remains healthy relative to the outlook for the next few months, something we expand on in the video below.

From Wall Street's perspective, the positive drivers for stocks in 2011 include:

- The recent extension of the Bush Tax Cuts.

- Little in the way of double-dip talk.

- Positive outlook for the economy and earnings.

- Favorable market seasonals and cycles.

- Many companies have large stores of cash.

- Consumer confidence is picking up.

- The Fed's desire to inflate asset prices.

- Consumer balance sheets have improved a bit.

- Stock valuations are not excessive (from the perspective of many).

- Low CPI inflation.

Part II of our 2011 stock market outlook expands on some of the concepts above with an emphasis on (a) what could derail the bull, and (b) the S&P 500's technical profile. The technicals are discussed in a manner that can be understood by both professionals and investors who have limited experience with market charts. Copies of the charts reviewed in the video, as of December 23, 2010, are below the video player. A larger version of the video player can be found here.

Part I of II can be found in Risk Assets Respond to Quantitative Easing.

Outlook 2011: Five Stocks Due For A Pullback (CAT, AMZN, NFLX, X, BIDU)

The following are just five of such candidates that I believe capable of some meaningful downside actions, and is not intended to be an all inclusive list.

Could This CAT Bounce?

Caterpillar (NYSE:CAT) stock has had an enormous run and has finished the year right at its 52 week high mainly on the emerging markets and global resources/commodities trade. A very well run corporation, but there are a couple of challenges for 2011.

First of all, everybody and their uncle are already in this stock. Second, the 31 P/E Ratio for a Farm & Construction Machinery company seems a little rich when compared to an Apple for example, with a P/E Ratio of 21, and they are a tech firm which usually carry higher P/E Ratios.

Third, China, a major market for CAT, is battling an escalating inflation problem, and I expect Beijing to undergo a severe tightening during the first half of 2011, with at least three interest rate raises during 2011. Last but not least, due to global inflation pressures, CAT`s input costs are going to go up, which puts a squeeze on margins.

Look for a significant pullback to the $84 level where it should find some initial support, with the 80 level being much stronger support. If CAT breaks the $80 level this should be a warning sign for investors to re-evaluate the reasons for this technical breakdown. Is it a general stock market decline, or something company specific like a bad earnings report with poor guidance going forward.

Just remember that any noteworthy negative news regarding the global growth story could affect CAT more than the general market, and specifically, if you see a selloff in the agricultural space due to tightening measures, caterpillar will experience its share of red in market cap.

Amazon (NASDAQ:AMZN) – It's a VaR Jungle Out There

This is another momentum stock from 2010, and talk about high expectations built into this stock as AMZN has a lofty P/E Ratio of 74. Amazon is also finishing the year right at the top of its 52 week high at $182 a share.

I think the best argument for a pullback in this stock is to look what happened last year. Amazon started 2009 at around $54 a share and finished 2009 at approximately $137 a share, a similar stellar liquidity driven year as 2010. Well, the stock pulled back dramatically at the start of 2010 going from the 52 week high area of $137 starting the year to the $116 a share level by February 8th.

Basically a five week decline on pure profit taking after portfolio managers ran the stock up at the end of the preceding year trying to maximize their numbers. I would expect a similar decline for the beginning of this year as well, maybe even some early sellers the last week of the year trying to beat the herd to the exits on this stock.

Expect the pullback to test the $160 area, and if earnings disappoint in late January, expect a sharper correction to the $145 level as short sellers pile in on technical breakdowns pushing stocks lower than they ordinarily would drop on just profit taking alone. That`s the thing you have to remember about Wall Street, stocks usually go a lot lower or higher than you can ever imagine once a directional shift picks up momentum.

On the fundamental side of the equation, Amazon is basically a retail play, and the holiday season is their strongest part of the earnings each year. Once the holidays are over, the stock lacks a catalyst going forward because unlike last year, the company doesn`t have a similar new product like the Kindle offerings to inspire investors. In fact, with a dozen new tablets hitting the market in 2011 in all shapes and sizes, expect much more competition in terms of content providers and device readers.

I'd be very careful with Amazon if you're long. The stock appears to have little if any immediate upside potential, and is almost a certainty to pullback to $170 faster than you can say "I should have sold when it was $185". Furthermore, there is much more downside risk when a stock has run up this much.

The obvious strategy now is to take profits, wait for the inevitable pullback, and get back into this stock ideally after the summer doldrums where most techs are week. A good time to buy this stock would be around late July as last year there was a prolonged selloff starting in late April to the start of July where it was around $110 a share.

I would expect a selloff at the beginning of the year. Then buyers would come in and buy the first dip, before the yearly low is put in again during the second selloff of the year around July. There is a reason the old axiom of "Sell in May, and go away" exists in the investing lexicon. The summer often is exemplified by lower VaR (Value at Risk) by the institutional investors, and is historically replete with some of the weaker investment months of the year.

The goal should be to buy the second selloff of the year, and ride the stock straight through the annual Christmas run up through late December.

Netflix (NASDAQ:NFLX) – Another AOL?

This is a stock that befuddled many shorts in 2010, until it finally had a nice pullback after soaring to $209 a share around December of 2010. However, as stated in my previous analysis, there is more downside ahead for this stock as it is still quite pricy with a P/E Ratio of 70. It was also in a sweet spot in terms of competitors with the bankruptcies of the brick and mortars in the space.

The company was successful enough for others to take notice, but you may expect new product offerings from existing players, and entirely new players altogether in the space for 2011. In short, Netflix`s sweet spot in the space is over.

Technically speaking, expect the pullback to test the $150 level during the first quarter of 2011, and if there is a major earnings disappointment, the $120 level of support is next in line for this stock. If it breaks the $120 area, then chances are this represents a broken stock, and it is best advised to avoid catching the falling knife even on a valuation play. Remember, this stock was a momentum stock, a fad stock, and heavily shorted in 2010.

So far, there seems nothing in Netflix`s business model that cannot in some way be outdone, duplicated, or even refined in a more appealing, efficient product offering by a large competitor with much bigger pockets. So, there will be a new momentum stock in 2011, the shorts will no longer be adding fuel to the fire via successive short squeezes, and all fads come to an end as consumers look towards the next cool thing.

NFLX is another stock with very limited upside and an abundance of downside risk at this point for savvy investors. The question with this stock a la CROX, is not whether this stock pulls back, but more so of how low will it fall, remember CROX`S fall from the $75 area at the peak of its hype all the way to a dollar a share in a year`s time.

The tech sector currently is looking more and more like the tech bubble back in 2000. So, the other intriguing question is whether Netflix would even be around in five years time with the evolutionary changes bound to occur in this space?

It could be Netflix presence in the space might resemble an AOL type of scenario in which after changes in technology made AOL`s business model obsolete– Could Netflix end up being another AOL?–just hanging around in a reduced state for a decade after their glory days? And AOL was a lot bigger than Netflix back then. It is certainly something to pounder upon.

Bottom line is that investors who are currently in the stock should pick a point where they will get stopped out of this stock if the momentum run is indeed over in 2011.

United States Steel (NYSE:X) – Better Be A Price Taker at Lower Levels

This is another stock that is ripe for a pullback, and investors should book some profits before the New Year when others are sure to follow suit.

US Steel was $40 a share in late October, and it piggy backed with the rest of equities the last 8 weeks of 2010 where it sits at the $58 share level, all this with a negative earnings per share to its credit. Expect the stock to test the $45 a share level during the first quarter of 2011, probably sooner than later as the last 8 weeks run up just doesn`t have staying power given the fundamentals in the global economy and the steel market.

Last year the stock performed this same type of run up into year-end only to pullback significantly in the New Year–in late October of 2009 X went from $35 a share to close out the year near $56 a share in December, it even continued the run for a couple of weeks in January to around the $65 level, only to fall back precipitously to $44 a share by February 8th of 2010.

Expect the same type of pullback in US Steel for 2011 as this is just a trade for money managers, taking advantage of year end momentum to push up stocks and hit their year-end targets. There should be strong support at the $40 a share level for those interested in getting back into this stock on a pullback. However, if it breaks $37 a share, there is something wrong with this company, and that is your max pain threshold.

A good rule of thumb regarding established companies like US Steel from a technical standpoint is to look back at the two year chart of the company (although I only show one-year charts here) , and there are two spikes above the current level, and the stock didn`t stay at those levels very long. In fact, the stock spent much more time trading well below the current levels than above it.

From a logical risk and reward standpoint, do you want to be a buyer or a seller at these levels? For the investor it makes sense to put as much of the odds in your favor, since most investors are price takers, and not price makers, the obvious choice is to be a price taker at a much lower valuation level.

Baidu, Inc. (NASDAQ:BIDU) – China Tightening Hurts

BIDU is a high flying tech stock has had quite a run with the highest P/E Ratio in the group at an astounding 83. Part of the rationale to expect a pullback in this stock is that China is going to have a tough time of things for the first half of 2011 while they are in super tightening mode.

Beijing hiked interest rates 25 basis points on the 25th of December, and I expect 3 more rate increases during the first half of the year as they try to tackle an ever present inflation problem in their economy. As the Chinese market pulls back, so will the US market, but especially stocks that are closely tied to the Chinese market such as Bidu.

As we speak, the stock is around $100 a share, and expect a significant pullback to the $80 a share level during the first quarter of 2011. The next major area of support is around the $70 a share level. If it breaks $70 a share, some serious questions need to be answered before getting back in on this stock like "Is China`s bubble bursting?" or "Is there a new direct competitor in China?" etc. as this is a technical breakdown of the stock.

From a technical standpoint Bidu has already started to show signs of putting in a near-term top, as the rest of the market was exploding higher, up 6.5% so far in December, BIDU was actually on the downswing from the $110 high established December 6th. The reason is that China was pulling back on tightening concerns. Well, every week there is some kind of new tightening measure coming out of China, and this is what is pulling Bidu down, in my opinion.

So now that China has started pulling out the big guns in terms of tightening with interest rate hikes, expect Bidu and the Chinese market to pull back even further. Throw in a long overdue US equities pullback into the equation, and you get the picture–it is not unreasonable for Bidu to test the $80 a share level in the next six weeks.

But when you have a down trending stock like BIDU in an otherwise robust market, it seems to be sending signals that there is more weakness to come. The idea is that if it is weak now, it should be even weaker when the entire market starts to pull back in early 2011.

Goal – Not Be The Last Standing

The one thing we have learned during the last decade is that the buy and hold strategy for the most part is dead, it has been a trader`s market, and the smart money isn`t going to wait for an engraved invitation to sell at these levels. Avoid being the last person standing looking for the musical chair.

Meanwhile, I would be interested in some of the other candidates that readers think fit the bill as well for potential pullback targets.

Ford To Expand Fuel-Saving Start-Stop Technology From Hybrids To Conventional Cars, Crossovers

DEARBORN, Mich., Dec. 27, 2010 /PRNewswire/ —

- Ford's Auto Start-Stop system will be available for North American cars and utilities in 2012

- Ford's Auto Start-Stop system boosts city fuel economy between 4 and 10 percent

- Since 2004, Ford has sold more than 170,000 hybrid vehicles in North America with start-stop and is the leading domestic producer of the systems

- Ford has at least 244 worldwide patents on its Auto Start-Stop technology, proven on hybrids and soon to be added on cars, crossovers and SUVs in North America

Ford's popular fuel-saving technology that automatically shuts off the engine when the vehicle comes to a stop – a feature found today on the Ford Fusion Hybrid and Ford Escape Hybrid and some Ford cars in Europe – will soon be added to conventional cars, crossovers and SUVs in North America.

Ford's patented new Auto Start Stop system for gasoline engines will improve fuel economy for most drivers by at least four percent. The gain can be as high as 10 percent for some drivers, depending on vehicle size and usage. It can also reduce tailpipe emissions to zero while the vehicle is stationary or waiting at a stop light. Ford has more than 244 patents for its Auto Start-Stop technology and will showcase the feature on a concept in January at the North American International Auto Show.

Auto Start-Stop is the latest example of Ford moving aggressively to bring affordable advanced fuel-saving technologies to all customers. Ford has already introduced electric power steering, dual-clutch PowerShift six-speed transmissions and other fuel-saving features as part of the company's commitment to lead or be among the leaders in fuel economy in every segment.

Ford's global Auto Start-Stop technology is smooth, quiet and seamless, and it requires no changes to the driver's behavior. In city driving when the vehicle is stopped, the engine restarts the instant the driver's foot leaves the brake pedal. When the engine is off, all of the vehicle's accessories function normally.

"For the driver, Ford Auto Start-Stop provides extra fuel efficiency without inconvenience, as it works completely automatically," said Barb Samardzich, Ford vice president of Powertrain engineering. "And, just like in our hybrid vehicles, the heater, and air conditioner work as normal so drivers will not sacrifice comfort."

The global rollout of Auto Start-Stop is under way in Europe. The system, designed to work on both gasoline and diesel engines, is standard on the ECOnetic models of the Ford Ka and Mondeo, and is launching now on Focus, C-MAX and Grand C-MAX. The fuel-saving system debuts in North America in 2012 and eventually will be offered in all of Ford's global markets.

Many North American Ford customers are already familiar with Auto Start-Stop. A similar system has been installed on more than 170,000 gasoline-electric hybrid vehicles Ford has sold since 2004. Ford is the leading domestic producer of start-stop systems. In 2011, the version of Ford's Auto Start-Stop designed for gasoline-electric powertrains will be on the Escape Hybrid and Fusion Hybrid as well as the Lincoln MKZ Hybrid.

"Many of the same Ford engineers who designed the Auto Start Stop system used on Ford and Lincoln hybrids are developing the Auto Start-Stop system for non-hybrid vehicles that will be sold around the globe," said Samardzich.

When Auto Start-Stop debuts in North America, it will be available on gasoline-powered cars and utilities with either a manual or automatic transmission as well as vehicles that use Ford's patented dual-clutch six-speed automatic transmission.

Ford's aggressive move to direct-injection EcoBoost™ engines is one of the technologies that enable the Auto Start-Stop system to work seamlessly, Samardzich said. The direct-injection system, which sprays the exact amount of fuel directly into the precise location in the combustion chamber, helps enable extremely fast engine starts, Samardzich explained. The system debuts on four-cylinder engines and will gradually be expanded to vehicles with V6 and V8 engines.

Auto Start-Stop does not require any additional vehicle maintenance. The system uses an enhanced 12-volt automobile battery and upgraded starter motor, said Birgit Sorgenfrei, program manager for Auto Start-Stop.

"Our hybrid owners tell us that start-stop is one of their favorite features," said Sorgenfrei. "When the engine is off, they know they are saving fuel and reducing emissions."

The system includes a light on the dash that alerts the driver when the engine is off and a special tachometer that moves the needle to a green zone when the engine is not running.

Ford engineers are making customer comfort a priority in engineering the system. A special electric pump keeps engine coolant circulating through the heater so drivers will stay warm in cold weather, Sorgenfrei said.

"Ford's start-stop technology conserves fuel and eliminates emissions at every vehicle idle opportunity once customer comfort and convenience are assured – this is good for the environment," Sorgenfrei said.

Auto Start-Stop is just the latest in a long list of fuel-saving technologies Ford has brought to market in recent years.

Ford's industry-leading suite of fuel-saving technologies include:

- EcoBoost engines, which combine turbocharging, direct injection and twin independent variable camshaft timing or Ti-VCT, with downsizing to deliver outstanding fuel economy without sacrificing performance

- Improved and highly fuel-efficient TDCi turbo-diesel engines in European models with low emissions and high levels of refinement

- Electric power steering, which eliminates the engine-driven hydraulic pump, lines and fluid

- Six-speed transmissions, which enable engines to run more efficiently by always selecting the best gear for fuel economy

- PowerShift dual-clutch automatic transmission, which efficiently sends the engine's power through the transmission without relying on a torque converter or hydraulic pumps

In 2011, Ford will be the only manufacturer in North America to offer four vehicles that get 40 mpg or more. Those vehicles, the Ford Fiesta, Ford Focus, Ford Fusion Hybrid and Lincoln MKZ Hybrid, are part of a dozen vehicles leading their sales segments in fuel economy, a record no other manufacturer can match.

"Ford Auto Start-Stop works so fast and so seamlessly, most drivers won't even notice it is there, though they will notice the benefits in their lower fuel bills," Samardzich said.

About Ford Motor Company

Ford Motor Company (F: 16.78 -0.21 -1.24%), a global automotive industry leader based in Dearborn, Mich., manufactures or distributes automobiles across six continents. With about 176,000 employees and about 80 plants worldwide, the company's automotive brands include Ford, Lincoln, Mercury and, until its sale, Volvo. The company provides financial services through Ford Motor Credit Company. For more information regarding Ford's products, please visit www.ford.com

SOURCE Ford Motor Company

Momentum Stock: The Cooper Companies, Inc.

The Cooper Companies Inc. (COO: 56.66 -0.27 -0.47%) just hit a new multi-year high at $59.11 after reporting an impressive Q4 earnings surprise of 20% in early December. With estimates up on the news and the valuation picture in check, this Zacks #1 rank stock has its sights set on momentum.

Company Description

The Cooper Companies, Inc., through its subsidiaries, develops and manufactures vision and women's health products. The company's products include contact lenses and medical devices like diagnostic and surgical equipment used primarily by gynecologists and obstetricians. Cooper Companies was founded in 1980 and has a market cap of $2.6 billion.

Cooper Companies gave its investors reason to cheer on December 7 with strong Q4 results that came in ahead of expectations and put a rubber stamp on a great year for the healthcare-products company.

Fourth-Quarter Results

Revenue for the quarter was up 11% from last year to $313 million. Earnings looked even better at $1.04, 21% ahead of the Zacks Consensus Estimate.

Most of Cooper's revenue comes from it vision segment, where total sales were up 10% from last year to $263 million. From that group, it's Toric products, also known as soft contact lenses, saw the biggest gains, up 14% to $78 million. Its highest revenue product from this segment, non single-use sphere, was up a solid 10% to $110 million.

In terms of regions, Visions biggest gain came from its biggest region, Americas, up 47% to $124 million. It's Asia business, representing less than 20% of total revenue, was up a respectable 6% to $48 million.

Cooper's smaller division, women's medical products, was up 14% to $50 million.

Not only were sales strong, costs and expenses were down, with gross margin showing a big gain to 60% from 56% last year. Operating margin was 20%, looking strong in both categories.

Balance Sheet

Buying a bunch of small companies and combining them underneath one umbrella can be expensive, and it shows up in Cooper's balance sheet, with total debt of $611 million, down $35 million from last year, and nominal cash and equivalents of $3.5 million.

Estimates

We saw some decent movement in estimates off the good quarter, with the current year gaining 26 cents to $3.46 while the next-year estimate added 28 cents to $3.84.

Valuation

With a forward P/E of 16.5X, COO trades at a slight premium to the industry average of 13.5X.

6-Month Chart

On the chart, COO jumped higher on the strong quarter, hitting a new multi-year high at $59.11. But in spite of the gains, the stochastic below the chart is signaling that shares are trading far away from over-bought conditions. Look for support from the longer-term trend on any weakness, take a look below.

Last Week's Momentum Zacks Rank Buy Stocks

MWI Veterinary Supply, Inc. (MWIV: 64.54 +0.26 +0.40%) recently hit a new all-time high at $64.73 after rallying into the end of the year on a Q4 earnings surprise of 16% from early November. With an average earnings surprise of 23% over the last four quarters and bullish growth projection of 14%, this Zacks #1 rank stock could be your latest pet investment. Read Full Article.

Dollar Tree, Inc. (DLTR: 56.77 +0.48 +0.85%) continues to trade near its multi-year high at $57.06 on the heels of a solid Q3 earnings surprise of 18%. With consumers still flocking to discount retailers in the shaky economic recovery, this Zacks #1 rank stock has momentum to spare. Read Full Article.

RBC Bearings, Inc. (ROLL: 38.665 +0.315 +0.82%) recently hit a new multi-year high after reporting strong Q2 results in early November that included its third consecutive earnings surprise. Estimates have since jumped higher, with the next-year estimate projecting 23% growth, helping to eliminate upward resistance for this Zacks #1 rank stock. Read Full Article.

Michael Vodicka is the Momentum Stock Strategist for Zacks.com. He is also the Editor in charge of the market-beating Zacks Momentum Trader Service.

COOPER COS (COO): Free Stock Analysis Report

Crude Oil Drops Slightly On China Rate Hike, Gold Digests A 10th Year Of Gains

Commodities – Energy

Crude Oil Drops Slightly on China Rate Hike

Crude Oil (WTI) – $9.38 // $0.13 // 0.14%

Commentary: Crude oil is kicking off the new week to the downside after the People's Bank of China raised rates by 25 basis points over the weekend. Prices are well off the lows, however, as traders use the opportunity to buy. Readers may recall that last week crude oil broke out to a 27-month high after rising for five sessions in a row. Can the streak be kept alive this week? While there is no doubt the fundamentals are extremely supportive of the commodity at the moment—inventories are drawing down rapidly and global economic growth is continuing robustly—a correction at some point is to be expected given how fast oil has climbed. All that is necessary is a catalyst to spur traders to lock in profits. Though a single 25 basis point hike from the PBoC does not materially change the outlook for China and by extension oil, it may be enough to send prices lower temporarily. Overall, expect volume to be extremely light as we approach the end of 2010.

Technical Outlook: Prices have paused after taking out resistance at $91.17, the December swing high. Still, positioning suggests the door is open for an advance to test the upper boundary of a rising channel set from August (now at $92.26). The $91.17 level has been recast as near-term support.

Commodities – Metals

Gold Digests a 10th Year of Gains

Gold – $1383.90 // $2.43 // 0.18%

Commentary: Last week gold was little changed as capital flowed into other economically-sensitive risk assets. Prices are again doing little as traders await the next catalyst. Overall, 2010 was another solid year for gold, as the metal rose 26% (year-to-date), after rising 26% in 2009 and 5% in 2008. Prices have not put in a negative annual return since the year 2000. Obviously, this streak will end at some point. But the circumstances that have fueled this performance—ever-increasing investment inflows, central banks becoming net buyers, and now surging demand from China—have not gone away. Eventually, prices will reach a point where circumstances change, where supply and demand reach a more sustainable equilibrium—but there is no evidence of that happening yet.

Technical Outlook: Prices remain locked between $1392.46 and $1380.47, the 32.8% and 50% Fibonacci retracements of the 11/16-12/7 rally, respectively. A break lower exposes the 61.8% Fib at $1368.49, while a push through near-term resistance clears the way for a retest of a rising trend line set from mid-November, now at $1405.37.

Silver – $29.21 // $0.08 // 0.29%

Commentary: Silver continues to be well-behaved as the metal consolidates in step with gold.

The gold/silver ratio rose slightly to 47.4, near the lowest levels since February 2007. (The gold/silver ratio measures the relative performance of the two precious metals. A higher ratio indicates gold outperformance, while a lower ratio indicates silver outperformance).

Technical Outlook: Prices continue to consolidate between the 14.6%and 23.6% Fibonacci retracements of the 10/22-12/07 rallyat $29.55 and $28.85, respectively. A break above near term resistance exposes the latest swing high at $30.70. Alternatively, a push lower targets the 38.2% Fib at $27.70.

Bear Of The Day: Vulcan Materials Co. (VMC)

Despite being the largest producer of construction aggregates and a leading producer of other construction materials, Vulcan Materials (VMC: 44.82 -0.40 -0.88%) faces intense competition and a challenging environment.

The nearly stalled construction business has yet to show positive signs of recovery, jeopardizing the prospects of the building materials and other related products markets. In the most recent quarter, Vulcan failed to live up to the Zacks Consensus Estimate of $0.19 per share by posting a profit of only $0.08.

In addition, its cash position has also deteriorated. Based on the above conditions, we continue with our Underperform recommendation on the stock and set a target price of $36.00.

Yesterday’s 250-Point Rally Very Significant For U.S. Stocks

I'm looking at the major business newspapers this morning and I see one big story missing from page one of these newspapers, "Dow Jones up 250 points yesterday, single-day gain of 2.3%!"

Yesterday's big rise in the Dow Jones Industrial Average is very significant for the stock market.

As a leading indicator, the market predicted the turnaround in corporate profits months ago. That's why stocks are up about 70% from the spring of 2009.

While not moving in a straight line, the Dow Jones was able to reach a two-year high of 11,451 in early November. In all markets that rise for an extended period of time, profit taking is as natural as the snow the northern states will get this winter. Profit taking took the Dow Jones below 11,000 early this week and then, presto, just like a rubber band, the market rebounds with a huge 250-point rally.

Why do I see yesterday's one-day rally as significant? Because it signals that the bear market rally that started in March of 2009 still has upside potential. Investors, sitting with billions of dollars on the sidelines, only really have two things to worry about: The real estate market and higher interest rates in the U.S. Otherwise, it's a green light for corporate profits.

Look at it this way: An investor who bought the Dow Jones on Tuesday made more money on Wednesday than he or she would have by holding U.S. T-bills all year!

Just this morning…

Target Corp. (TGT: 58.60 0.00 0.00%), the major American retailer, said its same-store sales rose 5.5% in November from November 2009, beating analyst expectations.

Saks Inc. (SKS: 11.38 0.00 0.00%), the high-end retailer, said cash registers at its same-store locations rang up 5.3% more in sales this November than in November of last year.

Gap Inc. (GPS: 21.16 0.00 0.00%), a major American clothing retailer, said this morning its November same-store sales were up four percent from last year, also beating analyst expectations.

(I told my readers months ago to look at the retail stocks because they would surprise this holiday season on the upside…and they have. I still think the major retail stocks have more room on the upside for price appreciation.)

Corporations are pumping profits and investors have few choices when it comes to parking their cash. Stocks still look attractive at these prices levels.

Back to the major headline missing in today's newspapers…

Very few people writing about the financial news are seasoned financial analysts. What makes a great financial analyst: someone who has traded the markets for at least 20 years; someone who has a major economics or similar educational degree; a person who has studied technical analysis and has taken difficult courses on stock market analysis; and, most importantly, someone who has put their own money on the line and won.

But think about it for a minute. If a reporter possessed everything I just listed above, why would they be a reporter? Exactly; they wouldn't.

Michael's Personal Notes:

I flew back yesterday afternoon from Las Vegas and can tell you this about Sin City:

Tourists are starting to visit Vegas again. Sure, the hotels are cheaper than ever, and the casinos are not as full as they used to be, but business is 100% better than the dark days of late 2008 when Vegas went "dark" for months.

The problem in Las Vegas, like every other state that was fast-growing during the boom days that ended in late 2007, is the real estate market. House prices in Vegas are down 40% to 50% from their peak and show no signs of recovery. Developers built condo buildings hoping gamblers would buy them as second homes, and this idea, for the most part, flopped as well.

The Cosmopolitan of Las Vegas (a huge 2,000-room hotel/casino development) is scheduled to open before Christmas. Deutsche Bank took over the hotel after it foreclosed on its mortgage. I find it very interesting that the bank has decided to keep the hotel complex as opposed to selling it. The bank is likely willing to wait until the market improves before selling the hotel, a big vote of confidence for Vegas.

Vegas looks a lot like the rest of the U.S. right now: Consumers are slowly opening their wallets, real estate is very depressed, and high rollers, while nowhere near the many that existed in 2006 and 2007, seem to keep the baccarat tables open.

(On a side note, in November, we broke a record for the number of people who signed up to get PROFIT CONFIDENTIAL—17,776 new readers in one month! Welcome to our thousands of new readers. Each day on these pages, as financial writers, we try our best to analyze today's economic news with a different spin. Like a baseball game, we try to go to where the ball is going, not where it has been. It is very satisfying for our editors to see so many new readers. Thank you!)

Where the Market Stands; Where it's Headed:

The Dow Jones Industrial Average starts this morning up 7.9% for 2010. The bear market rally in stocks that started in March of 2009 is alive and well.

What He Said:

"Even the most novice investor can now read the chart of the Dow Jones U.S. Home Construction Index and see that it is trading at its lowest level in five years. If, like me, you believe that stocks are an indication of what lies ahead, this important index is telling us housing prices are headed to 2002 levels! What would that do to the economy? Such an event would devastate the U.S." Michael Lombardi in PROFIT CONFIDENTIAL, December 4, 2007. That devastation started happening the first quarter of 2008.